Every state has its own unique laws regarding how auto insurance works in the case of an accident, but there is one group of states with a defining distinction. The no-fault states use no-fault auto insurance laws. These laws impact what type of insurance the state requires drivers to have, how drivers go about filing insurance claims, and the potential outcome when a motorist seeks compensation for damages with the help of a car accident lawyer.

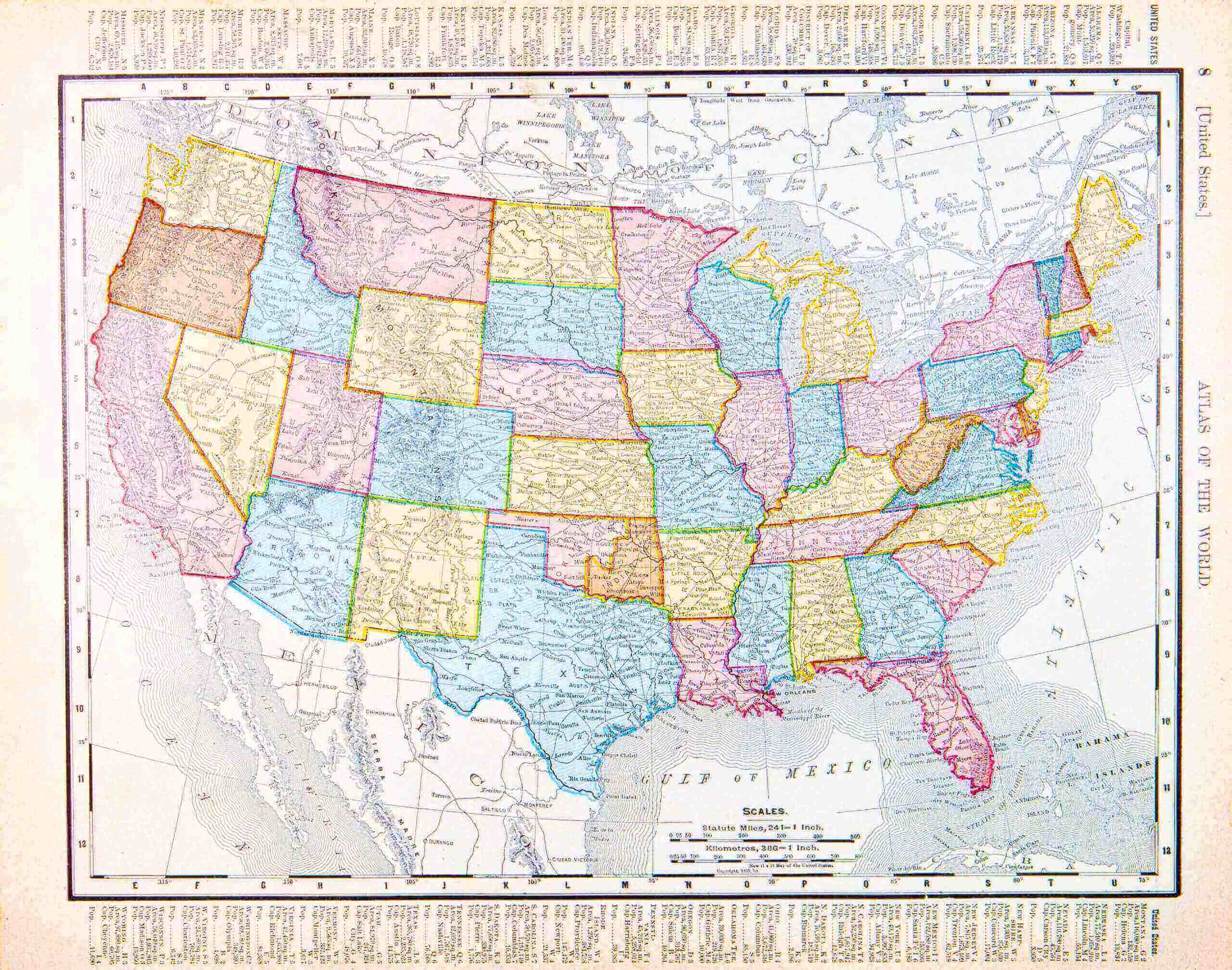

What States Are No-Fault States?

In California and the 37 other at-fault states, if you were to get in an accident on the road, your car insurance company won’t automatically compensate you for your medical costs. What happens is, you have to first prove that the other party is at fault; in these states, the fault is determined before anyone receives compensation. Then you can seek compensation for damages from the at-fault driver.

This also means that another motorist or passenger can go after you for damages if you are fully or partially at fault for the accident. Because of the nature of the at-fault system, which is also known as a tort system, it’s a good idea to consult with an accident attorney soon after an accident. An experienced personal injury attorney can help you prove the other party is at fault and ensure you receive the compensation you are entitled to.

With no-fault auto insurance states, the drivers in the accident file with their own insurance company, no matter who was at fault. Usually, drivers in no-fault states are required to have personal injury protection (PIP) as part of their auto insurance policy, which covers drivers for some personal injury damages. Only in certain cases can motorists sue the other driver for damages in no-fault states.

Here’s a list of each no-fault state in the US to give you an idea of how auto insurance laws work across the country.

Utah – In Utah, drivers are required to carry a minimum of $3,000 in PIP (personal injury protection). In the case of an auto accident, your insurance company will pay for damages up to this amount. Essentially, this means that in minor accident cases, the burden of carrying adequate insurance falls on the injured party.

In more severe accidents where personal injury damage exceeds $3,000, you can sue the at-fault party. Then, once your case is settled or the court gives you a judgment, your insurer will be reimbursed for the $3,000 that may have spent on your behalf.

Minnesota – This is a state with some of the most affordable car insurance in the country, but you’ll also see strict PIP requirements. In Minnesota, drivers are required to carry $40,000 in personal injury protection insurance. If your damages exceed the minimum threshold of $40,000, you can make a claim against the at-fault party’s bodily injury liability coverage.

However, you don’t have to have over $40,000 in medical bills. In this no-fault state, $20,000 of your PIP amount can be used to compensate you for medical expenses, and the other $20,000 can be used for lost wages and other non-medical expenses.

North Dakota – This is another Midwestern state with a high PIP minimum requirement. In North Dakota, drivers legally must carry at least $30,000 in personal injury protection insurance. If an accident occurs, no matter who is at fault, your insurance provider will pay for coverage for injuries up to that amount.

The threshold for seeking compensation from the at-fault motorist’s insurance company is lower in North Dakota than it is in other no-fault states. If your medical bills are more than $2,500, or in the case of serious injuries that lead to permanent disfigurement or disability, you can go after the other driver’s insurance company for personal injury damages.

Michigan – In Michigan, the mandatory personal injury protection coverage will pay for necessary medical expenses and up to 85 percent of lost income for up to three years. Unlike other no-fault states, in Michigan, there is no limit to compensation for medical costs from your insurer.

Michigan also has one of the highest PIP minimum requirements. Drivers have to have $1,000,000 in PIP coverage.

Pennsylvania – This state has one of the most complex no-fault auto insurance laws. In Pennsylvania, drivers can choose between no-fault and at-fault rules, making this a “choice no-fault” state. What happens in Pennsylvania is, drivers decide which type of fault system they want to use when they purchase auto insurance.

If a driver chooses no-fault auto insurance, they will file a claim with their own insurance provider for medical bills and lost wages, even if the other driver is at fault. With the no-fault system, a driver can’t seek compensation for pain and suffering or emotional distress except for extreme circumstances.

New Jersey – In New Jersey, the standard personal injury protection coverage amount is $250,000, although you can choose to adjust it. You’ll also have the option of buying two types of PIP – one type covers medical expenses, and the other can be used to cover some of your lost wages. You’ll also determine if you should make the PIP coverage your primary coverage or if you want to use your personal medical insurance as your primary coverage.

This is one state with a lot of nuances in the no-fault auto insurance system. The choices you make when purchasing insurance will have a huge impact on what happens when you need compensation for your injuries.

New York – Motorists in New York are required to carry $50,000 of personal injury protection at the minimum. PIP can be used for necessary medical costs for the driver and passengers. It also provides coverage for you and your family members if another driver hits you when you’re a pedestrian.

For New York, PIP no-fault benefits can cover medical bills, lost wages, prescription drugs, and the costs of transportation to and from medical providers. To be eligible for these benefits, you’d have to file your claim within 30 days of the date of the accident.

Massachusetts – In this state, drivers are required to carry only $8,000 in personal injury protection. But, unlike with other no-fault states, your auto insurance company only pays a fraction of that amount, unless you don’t have health insurance.

In the case of an accident, PIP covers the first $2,000 of your medical expenses. After that, your health insurance goes into effect. If you don’t have health insurance, PIP will pay up to $8,000, or more if you purchased a higher amount.

Kansas – In this no-fault state, the minimum PIP standards require drivers have to have at least $4,500 for medical expenses and $900 per month for up to one year to cover lost income or disability payments. This personal injury protection will kick in no matter who was at fault in an accident.

The threshold for seeking damages against the other party is relatively low in Kansas. If your medical bills exceed $2,000 or if you end up with severe or permanent injuries, you can file a claim against the at-fault driver’s insurance company.

Kentucky – This is another state that offers motorists a choice when it comes to no-fault insurance. When you take out an auto insurance policy, you can take out the minimum requirement of $10,000 in personal injury protection. If you include PIP in your insurance policy, you are guaranteed coverage for your medical costs for at least $10,000.

On the other hand, if you choose no-fault insurance in Kentucky, you can’t sue the at-fault driver unless your medical expenses exceed $1,000 or the accident causes a serious or permanent injury. If you don’t accept PIP when you purchase insurance, there are no thresholds you have to meet before you can make a claim for damages with the at-fault driver’s insurance company.

Florida – Florida recently reenacted its no-fault insurance laws in 2008. In Florida, drivers are legally required to carry at least $10,000 of no-fault insurance coverage. This PIP coverage won’t cover 100 percent of your medical expenses, however. It can be used to cover 80 percent of medical bills, 60 percent of lost wages, and 100 percent of replacement services costs.

As with many of the no-fault states, drivers should act quickly to claim PIP benefits. In Florida, you’ll need to file a claim within 14 days of the accident.

Hawaii – In Hawaii, drivers are required to carry personal injury protection or managed care coverage, which is referred to as PIP or PPO. The minimum requirement for PIP is $10,000. If an accident occurs, your personal injury protection benefits are used to pay for medical expenses and rehabilitation costs.

Drivers in Hawaii can only sue in the case of a serious injury. The threshold for suing the at-fault driver in this state is $5,000 in medical expenses.

Frequently Asked Questions About No-Fault Insurance States

Can you sue in a no-fault state?

If you’ve been in an accident that another driver caused, you may still be able to sue the other driver for damages, but only if the accident caused severe injuries or permanent damage. While this may seem unfair in some situations, it helps to streamline the process of recovering damages for the large number of minor accidents that occur on the roads. Instead of needing to prove fault – as you’d have to do in California – before seeking compensation, all you have to do is file a claim with your insurance company, and they’ll pay for all covered costs.

Your medical expenses will have to exceed a certain threshold, which varies by the state before you can make a claim against the other party’s insurance company. In some no-fault states, the amount is minimal, such as in Kentucky, where the threshold is $1,000. In other states, such as Massachusetts, your insurance company will almost always cover all damages.

Who pays for car damage in a no-fault state?

For most road accidents in a no-fault state, each motorist’s insurance provider will pay for medical costs and lost wages, up to a certain amount. However, no-fault insurance generally does not cover vehicle damage. So, to receive compensation for damage to your vehicle, you’ll have to have collision insurance coverage in your auto insurance policy.

In no-fault states, you can’t sue the other driver for vehicle damage, even if the accident was entirely their fault. Your insurance company will pay up to the amount you have coverage for in your auto policy. Then, you’re responsible for the remainder if there are any costs leftover.

What does it mean to be a no-fault state?

A no-fault state is one that requires or offers the choice of no-fault insurance. States started enacting no-fault insurance laws in the 1970s in an attempt to protect motorists. With no-fault insurance, you’re guaranteed a certain amount of compensation, and you’re likely to receive compensation quickly.

Unlike in at-fault states like California, you won’t have to go through a litigation process to establish fault and to then receive compensation. This process can work well in the case of minor accidents. However, the reality is, medical costs can easily surpass no-fault insurance law thresholds, forcing victims of auto accidents to have to go through the litigation process anyway to get fair compensation.

In California, if you are in an accident, you’re insurance company isn’t going to pay for your medical expenses after an accident. You’ll have to wait until the state determines that the other party is at fault, and then their insurance company is legally required to pay for your losses. California is also a state that follows a pure comparative negligence system, which means, even if the other party is found to be one percent responsible, you can recover that one percent of damages.

Have Any Questions About Your State Law? Contact Quirk Reed LLP For Help Today!

The other party’s insurance company knows that you have to prove fault or they don’t have to pay anything. Because of this, they’ll use their experience and knowledge of how the system works to try to avoid paying for damages. This is why it’s so important to have an experienced personal injury attorney on your side. If you’ve been in an auto accident in California, contact Quirk Reed today for a free consultation.